short-term Treasury investments have shown an increase in their return, while stocks and long-term bonds have lost value.

A Treasury bill, or T-bill, is a short-term debt obligation backed by the U.S. Treasury Department. It's one of the safest places an investor can save his money. "Interest" on T-bills is the difference between how much investor pay and how much value investor get when the bill matures.

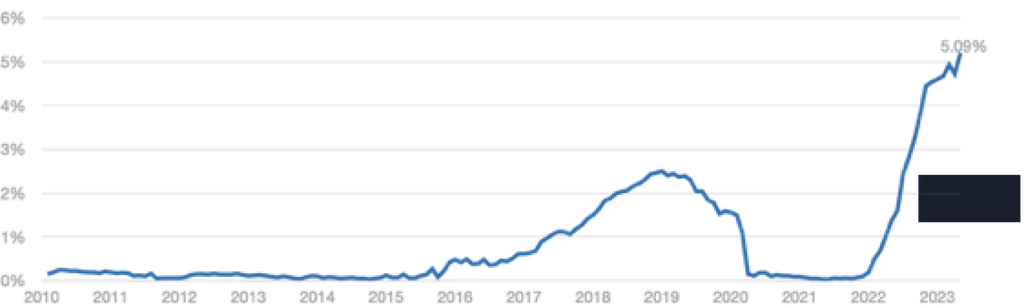

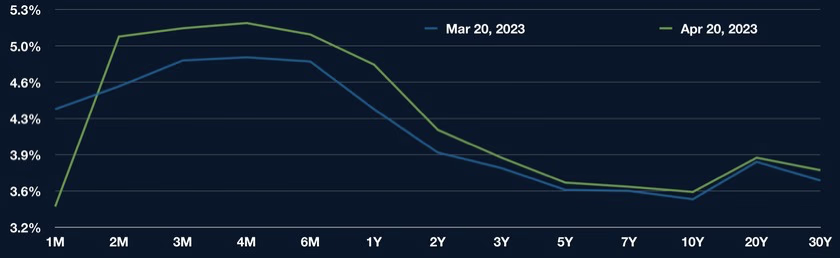

T-Bills investment can be a good option for investors seeking a low- risk asset with high liquidity. Is safe as they are issued by the US government and is highly liquid, which means they can be easily bought and sold in the secondary market.Currently, since Fed's current target rate is over 4.75% and expected to continue hiking, some T-Bills are almost reaching an all- time high. In particular, 6-Month T-Bills are offering fixed safe return above 5% annually, which is an attractive yield in the current market environment. In the past few weeks, there has been a substantial rise in the yields of T-Bills, primarily driven by the increased anticipation of higher interest rates.

Numa Americas Corp has been investing some of our strategies in T-Bills since late 2022, while continually analyzing other investment alternatives to optimize portfolios and deliver the best return-risk options to our clients. It is important to highlight that T-Bills are a temporal investment, just to take advantage of current high yields and protecting portfolios from market volatility. However, there are other investment options that may perform better, even with the current market conditions.